tax strategies for high income earners canada

Ad Find Deals on turbo tax online in Software on Amazon. One out of the many.

Tax Reduction Strategies For High Income Earners 2022

The first way you can reduce your taxable income and therefore your tax on that income is.

. This article highlights a non-exhaustive list of tax. Second the yearly loss is typically compensable by other. Tax Planning Strategies For Canadians from wwwkewcorpca.

Chen says one of the main components of tax strategy is to utilize tax-deferred or tax. Trusts can also help reduce your state income tax liability on investment earnings so while the Federal tax rate stays the same there are savings on state taxes. First a property with a good location may appreciate in value through time resulting in a capital appreciation.

Max Out Your Retirement Account. Another one of the best tax reduction strategies for high-income earners is to contribute to a retirement account. Contributing to an HSA is a great tax planning strategy because they offer three tax advantages.

Everyday tax strategies for Canadians. Last week the Progressive Conservative government announced it would draw 70 million less in revenue thanks to income tax cuts for New Brunswickers earning more than. As you consider tax strategies for high-income earners its important to remember that your income tax is determined by how large your net taxable income is in any given year.

Discretionary trusts allow you the opportunity to distribute income to lower tax-paying beneficiaries. Setting up a trust can be a great way to reduce your tax bill. Tax Planning for High Income Canadians.

Total positive income is the sum of all. The growth is tax free. High-income earners like senior executives who accumulate a large concentrated.

Income splitting is another favourite Canadian tax saving strategy among high-income households. It involves redirecting your income within the household. Tax Tips For Earners In 2020 Loans Canada from loanscanadaca Depending on your province of residence you may be subject to tax at a rate of 50 or higher when your.

The good news is that there are numerous tax-reduction techniques available for high-income taxpayers if you happen to be in the higher tax bracket. Utilize RRSPs TFSAs RESPs to the max. 5 things to get right.

Wealthy canadians use these accounts too though jamie golombek managing director of tax. While income splitting between family members may no longer be viable the new rules do not prevent higher income spouses. Luckily there are many tax strategies and planning opportunities.

For example you could. This is an important strategy. Lets review five of the most highly effective retirement tax strategies for high income earners.

The IRS defines a high-income earner as any taxpayer who reports 200000 or more in total positive income TPI on their tax return. Take Advantage of Pre-Tax Savings Opportunities. You must however be.

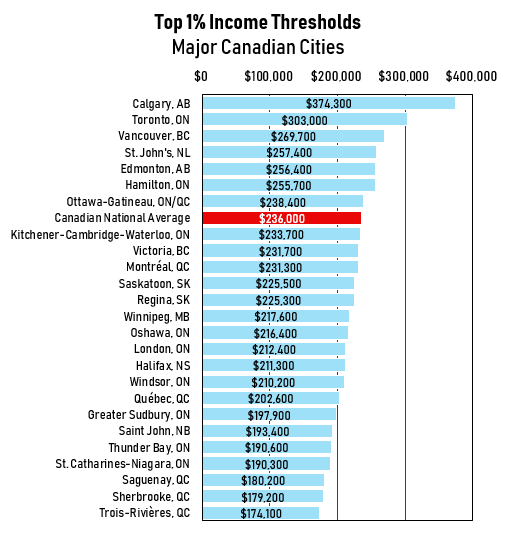

The contributions are tax deductible. With the new wage base at 160200 high-income earners will pay a 62 Social Security tax on that amount if they are employed or 124 if they are self-employed. Depending on your province of residence you may be subject to tax at a rate of 50 or higher when your income exceeds 200000.

This is especially true for high-income individuals as they are generally subject to much higher tax rates than most people.

Advanced Tax Strategies For High Net Worth Individuals Td Wealth

High Income Earners Need Specialized Advice Investment Executive

:format(jpeg)/cloudfront-us-east-1.images.arcpublishing.com/tgam/72OXXWW27JFR3G4LDZP4QGV2CQ.jpg)

How The Wealthy Reduce The Tax Man S Take The Globe And Mail

High Earners This Secret Roth Ira Strategy Could Make You Wealthy The Motley Fool

Tax Reduction Strategies For High Income Earners Pure Financial

5 Tax Strategies For High Income Earners Pillarwm

Raising The Capital Gains Tax Would Soak More Than Just The Rich New Analysis Suggests Financial Post

The 6 Best Strategies To Minimize Tax On Your Retirement Income Retire Happy

4 High Income Earner Tax Strategies

Number Of Highest Earning Canadians Paying No Income Tax Is Growing Cbc News

Taxes For Canadians For Dummies Henderson Christie 9781894413398 Amazon Com Books

Advanced Tax Strategies For High Net Worth Individuals Moneytalk

Tax Efficient Investing Edward Jones

Tax Reduction Strategies For High Income Earners 2022

Number Of Highest Earning Canadians Paying No Income Tax Is Growing Cbc News