how to reduce taxable income for high earners australia

There are many strategies to help you maximize your charitable contributions and reduce your income tax. Tax offsets should be improved.

Sell The Big Picture On Tax Reform Treasury Secretary

You can lower your taxes by setting up a mortgage offset account.

. You will lower your capital gains tax CGT liability. It is a great idea to donate to your superannuation or to your spouse so that you can reduce your. Sometimes it doesnt need much to move down a tax bracket.

Dont forget to keep accurate tax and financial records. How Do High Income Earners Reduce Taxes Australia. The Most Trusted US Expat Tax Software MyExpatTaxes.

How Do High Income Earners Reduce Taxes Australia. Some 709 people who had a total income of above 180000 were able to reduce their taxable income below the tax-free threshold. Ad Our Tax Experts Have You Covered for New Changes No Matter Your Income or Tax Situation.

To decrease your taxes open an account that can be accessed on a mortgage. Surgeons lawyers CEOs and miners dominated the top 10 high-income earners. Learn 15 simple ways to lower your taxable income in Australia.

Trustees would then only be taxed on income of 50000. When your taxable income is under 37001 to 126000 you receive most of whats known as the low and middle income tax offset. Superannuation contribution options to reduce taxes.

In order to be more tax deductible wealthy residents should donate low-cost basis stock contribute to a fund advised by a charitable organization or stack future charity donations a single year. The act of being charitable can make you feel charitable. It is important to keep accurate tax and financial records.

Reducing your capital gains tax CGT liability Making someone elses name your beneficiary A discretionary trust that distributes business or investment income. Maintain the effectiveness of your tax offsets. If your total income was 88000 and you made more than 1000 in deductions you would move down to a lower tax bracket.

Salary sacrificing super Salary sacrificing into super involves forgoing some of your pre-tax salarywages and putting it into super instead. You are taxed at a higher rate once you earn more than the threshold of each bracket. How Can Australian High Income Earners Reduce Taxes.

Pay back your salary to reduce your tax liability. In 2018-19 Australian men earned a median taxable income of 55829 compared to 40547 for women. How Can High Earners Reduce Taxable Income.

The Most Trusted US Expat Tax Software MyExpatTaxes. You will reduce the basis of capital gains tax CGT liability. If you can pay some of your expenses in advance you wont have to worry about paying them the next year and you can claim them as a tax deduction in the current year.

AAP The data revealed a stark difference between the earnings of Australian men and women. The act of purchasing assets in the name of your partner. Deductions that are allowable but not yet claimed.

Reducing all your deductions in order to maximize them. High-income earners should consider donating low cost basis stock contributing to a donor advised fund or stacking future charitable donations in a single year to maximize tax deductions. Mr Richardson explained that the most common method trustees used to reduce their taxable income was by what is known as income splitting.

No feel free to give to charity. This is a tax-effective strategy because super contributions are taxed at the concessional rate of 15 in Australia. Ensure you take full advantage of all of your tax deductions.

Increase the amount of tax offsets you make. For example if a business earned 100000 that money would first be put into a trust then split into two 50000 lots and distributed as income. Use Salary Sacsaving when working to reduce your taxable income in Australia.

Deductions can be claimed regardless of location. Your annual tax payable can be reduced by pre-paying some of your tax-deductible expenses agree such as prepaying the interest on an investment loan. They spent an average of 82507 on managing their tax affairs.

Expenses related to the mortgage. Ad Our Tax Experts Have You Covered for New Changes No Matter Your Income or Tax Situation.

How To Avoid Income Tax In Australia Ictsd Org

10 Easy Ways To Reduce Tax More Tips From The Etax Experts

How Do High Income Earners Reduce Tax In Australia Imagine Accounting

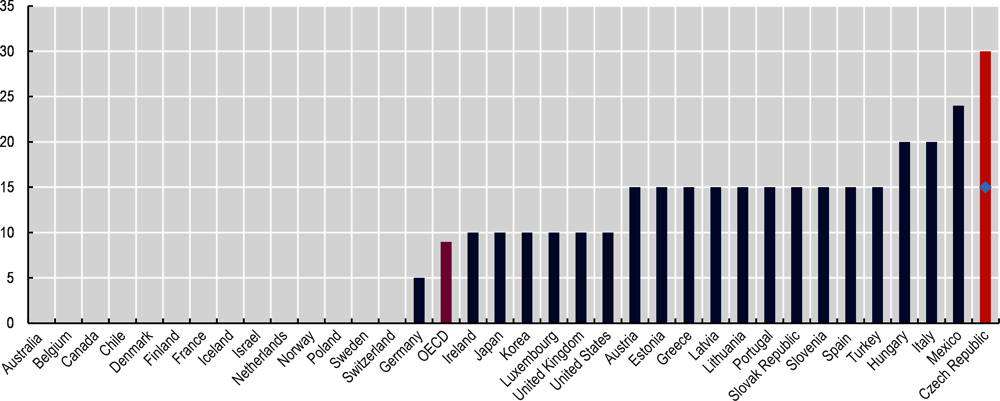

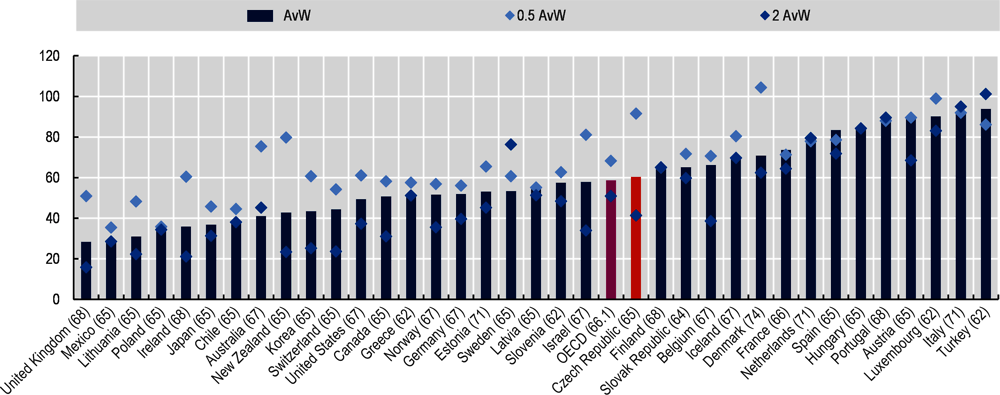

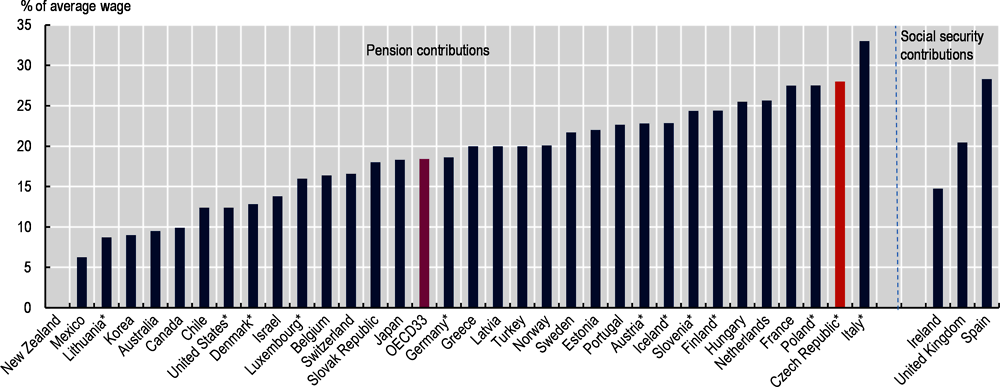

1 Mandatory Earnings Related Pensions Oecd Reviews Of Pension Systems Czech Republic Oecd Ilibrary

1 Mandatory Earnings Related Pensions Oecd Reviews Of Pension Systems Czech Republic Oecd Ilibrary

Why Are Women Working So Much More In Canada An International Perspective In Imf Working Papers Volume 2006 Issue 092 2006

How To Reduce Taxable Income 2018 Australia Ictsd Org

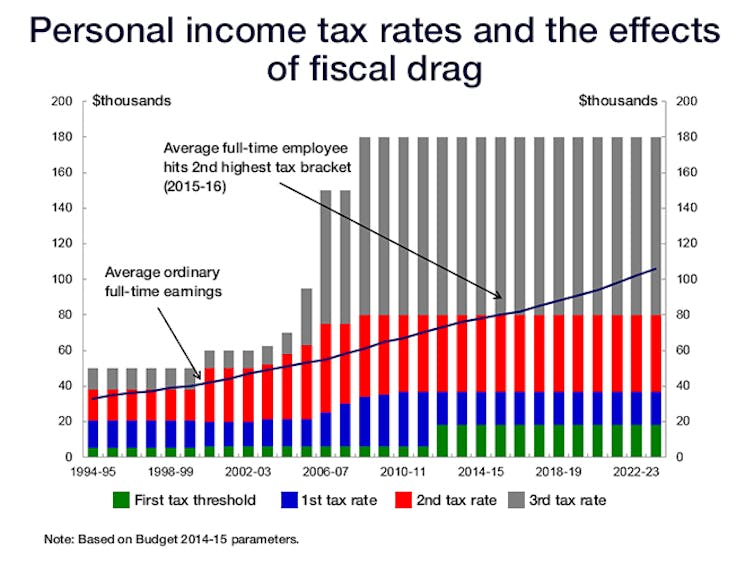

Personal Income Tax Progressivity Trends And Implications In Imf Working Papers Volume 2018 Issue 246 2018

Personal Income Tax Progressivity Trends And Implications In Imf Working Papers Volume 2018 Issue 246 2018

Is It Time To Make The Medicare Levy Progressive High Income Earners Can Afford It Greg Jericho The Guardian

How Raising Tax For High Income Earners Would Reduce Inequality Improve Social Welfare In New Zealand

Tax Progressivity In Australia Facts Measurements And Estimates Tran 2021 Economic Record Wiley Online Library

Fiscal Policy And Income Inequality In Policy Papers Volume 2014 Issue 040 2014

How To Avoid Income Tax In Australia Ictsd Org

How To Avoid Income Tax In Australia Ictsd Org

1 Mandatory Earnings Related Pensions Oecd Reviews Of Pension Systems Czech Republic Oecd Ilibrary